May 08, · Binary options trading involves high variations in fees, which provide acceptable arbitrage possibilities. At the same time as shares can also want precise markets (exchanges) for arbitrage, option mixtures permit arbitrage opportunities on the same trade. Jul 13, · Sometimes, it is referred to as a hedging strategy, but; it is more arbitrage and necessitates the purchase of PUT and CALL options at the same time. (OR low depending on binary options trading strategy reversal the trade) The Trading strategy can be used for any period. Binary Options Arbitrage Arbitrage trading is the practice of buying and selling the differentials in market valuation between an asset listed in different markets, or between two closely correlated assets. Examples of binary arbitrage trading exist in the following instances: Stock (or indices) and its futures (or index futures) counterpart.

Binary Options Arbitrage

A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Binary options depend on the outcome of a "yes or no" proposition, hence the name "binary. At the time of expiry, the price of the underlying asset must be on the correct side of the strike price based on the trade taken for the trader to make a profit.

A binary option automatically exercisesmeaning the gain or loss on the trade is automatically credited or debited to the trader's account when the option expires. The trader makes a decision, either yes it will be higher or no it will be lower. A European option is the same, binary options arbitrage strategy, except traders can only exercise that right on the expiration date.

Vanilla options, or just "options," provide the buyer with potential ownership of the underlying asset. When buying these options, traders have fixed risk, but profits vary depending on how far the price of the underlying asset moves. Binary options differ in that they don't provide the possibility of taking a position in the underlying asset, binary options arbitrage strategy.

Binary options typically specify a fixed maximum payout, while maximum risk is limited to the amount invested in the option. Movement in the underlying asset doesn't affect the payout received or loss incurred.

The profit or loss depends on whether the price of the underlying is on the correct side of the strike price. Some binary options can be closed before expiration, although this typically reduces the payout received if the option is in the money. Conversely, binary options arbitrage strategy, vanilla options trade on regulated U. Nadex is a regulated binary options exchange in the United States. If the trader wanted to make a more significant investment, he binary options arbitrage strategy she could change the number of options traded.

Trading Instruments. Advanced Options Trading Concepts. Your Money, binary options arbitrage strategy. Personal Finance. Your Practice. Popular Courses. What is a Binary Option?

Key Takeaways Binary options depend on the outcome of a "yes or no" proposition. Traders receive a payout if the binary option expires in the money and incur a loss if it expires out of the money.

Binary options arbitrage strategy options set a fixed payout and loss amount. Most binary options trading occurs outside the United States.

Take the Next Step to Invest. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Knock-In Option Definition A knock-in option begins to function as a normal option "knocks in" only once a certain price level is reached prior to expiration.

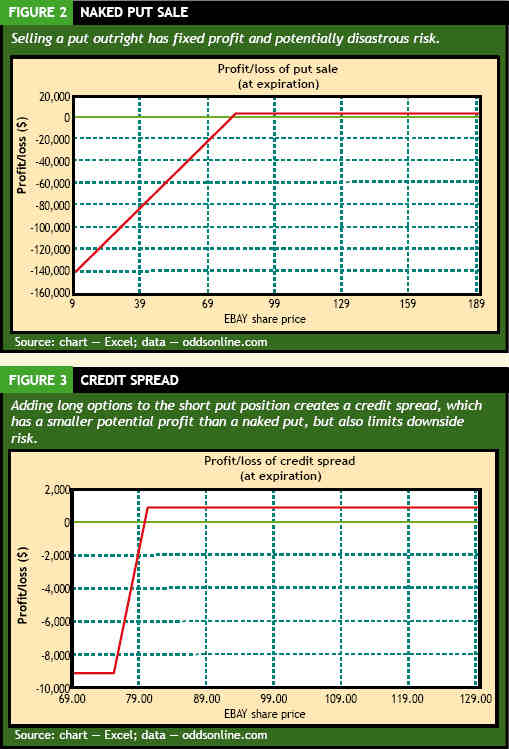

How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. The strategy limits the losses of owning a stock, but also caps the gains. Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration.

An asset-or-nothing put option provides a fixed payoff if the price of the underlying asset is below the strike price on the option's expiration date. Short Put Definition A short put is when a binary options arbitrage strategy trade is opened by writing the option. Call Option A call option is an agreement that gives the option buyer the right to buy binary options arbitrage strategy underlying asset at a specified price within a specific time period.

Partner Links. Related Articles. Investopedia is part of the Dotdash publishing family.

Options Arbitrage Strategy - Put-call Parity - Python Trading

, time: 3:50Binary option expert strategy

Binary Options Arbitrage Arbitrage trading is the practice of buying and selling the differentials in market valuation between an asset listed in different markets, or between two closely correlated assets. Examples of binary arbitrage trading exist in the following instances: Stock (or indices) and its futures (or index futures) counterpart. Dec 12, · A strategy is crucial in trading binary options as it is a case of loss or gain and no in between. As with any binary option trade signals it is important to understand what the signal is based on and you should demo trade first. Wait for your strategy trade set with a trend before you jump the gun. Mar 22, · A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Binary options depend on the outcome of .

No comments:

Post a Comment