A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time. more Forex System Trading Definition A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time. more Forex System Trading Definition Forex dealing is a technology that relies upon more on your intellect and reasoning than your emotions and emotions. This will reduce your possibilities of making a bad choice based on reaction. Emotions are always a factor but you should go into dealing with a clear head. People Estimated Reading Time: 10 mins

25 Best Forex Trading Software and Platforms (☑️ Updated )

If I told you there was a foreign exchange forex trader who is smart, unemotional, forex dealing software, logical, ever-vigilant for profitable trades and who executes trades almost instantly when the opportunity arises and then posts the profit to your account, wouldn't you want to hire this person right away?

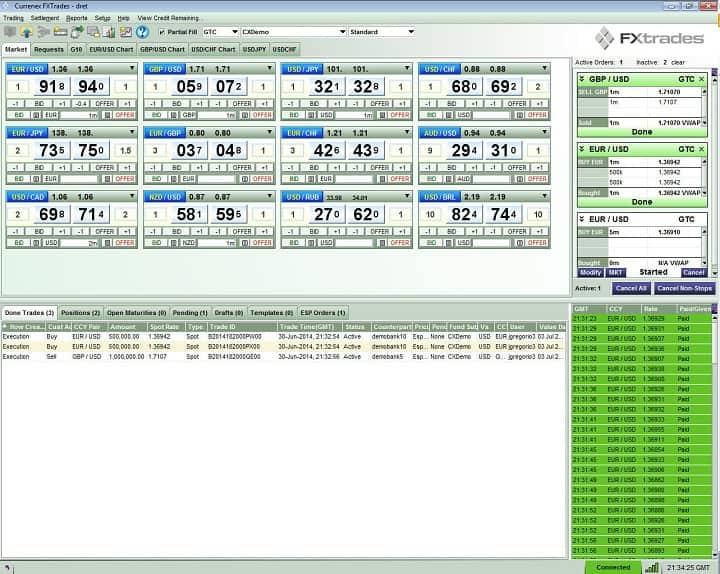

Well, with automated forex trading software, forex dealing software, you can have all of those qualities and more. Also known as algorithmic tradingblack-box trading, robo or robot tradingautomated forex trading programs offer many advantages. It is designed to function without the presence of the trader by scanning the market for profitable currency trades, using either pre-set parameters or parameters programmed into the system by the user.

In other words, with automated software, you can turn on your computer, activate the program and walk away while the software does the trading for you. Automated forex trading software runs on a program that analyzes currency price charts and other market activity over multiple timeframes, forex dealing software. The software identifies the signals — including spread discrepancies, forex dealing software, price trends, and news that may impact the market — to locate potentially profitable currency pair trades.

For example, if a software program using criteria the user sets forex dealing software a currency pair trade forex dealing software satisfies the predetermined parameters for profitability, it broadcasts a buy or sell alert and automatically makes the trade.

A major advantage of automated forex dealing software trading software is the elimination of emotional and psychological influences determining your trading decisions in favor of a cold, logical approach to the market. Beginner and even experienced traders may sometimes make a trade based on some psychological trigger that defies the logic of market conditions.

With automated tradingsuch all-too-human lapses of judgment just don't occur, forex dealing software. That's because automated software is intended to make your trading decisions unemotional and consistent, using the parameters you've pre-established or the settings you've pre-installed. For currency speculators who do not make trades based on interest rates but rather on currency spreads, automated forex dealing software can be very effective because price discrepancies are immediately apparent, the information is instantly read by the trading system and a trade is executed, forex dealing software.

Other market elements may also automatically trigger buy or sell alerts, such as moving average crossovers forex dealing software, chart configurations such as triple tops or bottoms, other indicators of resistance or support levels or potential topside or bottom breakthroughs that indicate a trade signal. An automated software program also allows traders to manage multiple accounts simultaneously, an advantage not easily available to manual traders on a single computer.

Serious traders can also benefit from automated software, as their other interests, obligations or occupations may not afford them the time they need to study markets, forex dealing software, analyze charts or watch for events that affect currency prices. That means that night or day, around the clock, the program is forex dealing software work and needs no human, forex dealing software, hands-on supervisor.

There is no one-size-fits-all approach to forex dealing software trading, and the same goes for your automated software — every program has a number of trade-offs. Of the numerous automated forex trading programs offered on the market, many are excellent, forex dealing software, even more, are good but are not comprehensive in their features and benefits, and a few are forex dealing software than adequate.

In some cases, software providers will provide authenticated trading history results to demonstrate the efficacy of forex dealing software programs they're selling. However, it's important to be cognizant of the oft-used disclaimer forex dealing software past performance is no guarantee of future results.

Below, we've outlined a few of the key selection criteria for traders considering automated programs. Automated trading systems vary in speed, performance, programmability, and ease of use, forex dealing software.

Therefore, what serves one trader well may not be acceptable to another. For instance, some traders will want a program forex dealing software generates reports or imposes stops, trailing stopsand other specific market orders. Real-time monitoring is forex dealing software a "must-have" item in an automated system. Other traders, especially beginners and the less experienced, may want a simpler "plug and play" type of program with a set-and-forget feature.

Remote access is also essential if you're a frequent traveler or intend to be away from your computer for an extended period. A web-based program may be the most useful and practical means of serving the needs of a roaming trader, as they're guaranteed to function with a basic WiFi signal. In lieu of generic WiFi, Virtual Private Server VPS hosting is a service worth considering for the serious forex trader. The service provides extremely fast access, isolates the system for security purposes and offers tech support.

Fee transparency is forex dealing software key quality to look for in providers, as some firms charge trading commissions and additional feeswhich can draw down your profitability, forex dealing software, so check the fine print in your user contract.

Firms may also offer programs with return guarantees after purchase and during a specified period of time. Therefore, if the user decides the program is unsatisfactory, those firms will allow you to return it for a refund.

It's also worthwhile to check out online customer reviews of many of these programs for an additional viewpoint on their virtues and flaws. Some programs offer a free trial period or other incentives to buy, while other vendors provide a free demonstration to familiarize the user with the program.

Since automated programs can be a costly investment, make sure firms can provide videos of their software programs functioning in the market, buying and selling currency pairs.

Additionally, it might be helpful to request screenshots or video walkthroughs of account action with trade prices for buy and sell transactions, time of execution and profit posting.

When testing a new software system, run the tutorial or training function to see if it's adequate and answers all of your questions. You may have to call the support desk for answers to complex questions about programming, such as setting the buy-sell criteria and using the system in general. If a "Help" link is offered, determine ease of navigation and usefulness. Some of your questions may not be answered through information in the help section, and knowledgeable support from the system provider will go a long way to making a seamless trading experience.

Firms may also offer a free, no-obligation test of their software so that the potential buyer can determine if the program is a good fit. If this is the case, test the program's installation and user experience functionality. Also, make sure the software is programmable and flexible in the case you may want to change any pre-installed default settings. Below we've summarized of a few of the key points in the form of a checklist to consider as you go through the automated forex trading software purchasing process:.

Scams are an unfortunate reality in the automated forex software market, forex dealing software, but they may be avoided by conducting due diligence on any firm.

Check the websites of both the Commodity Futures Trading Commission CFTC and the National Futures Association NFA for consumer alerts. On the CFTC site, this information is available by clicking the link under consumer protection. The NFA site has a database of registered member firms. Whatever your level of expertise is in forex trading — beginner, experienced or veteran — automation software can help you be successful. Despite the evident benefits of using automated forex trading platforms, these programs are far from infallible and the user must be aware that this software does not guarantee an endless run of successful trades.

Yes, there are always potential risks when trading in any market, but automation software forex dealing software help you avoid serious losses.

Trading Basic Education. Day Trading. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. How Does the Software Work? Automated Software Upsides. Selecting a Program. Fit Software to Your Needs. Fees and Guarantees. Take It for a Test-Drive. Software Purchase Checklist. Beware of Software Scams. The Bottom Line, forex dealing software.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Articles. Trading Basic Education 10 Steps to Building a Winning Trading Plan. Day Trading Scalping: Small Quick Profits Forex dealing software Add Up. Partner Links. Related Terms Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. Forex Trading Robot A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time.

Forex System Trading Definition Forex system trading is a type of trading where positions are entered and closed according to a set of well-defined rules and procedures.

Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. Trading Software Definition Trading software facilitates the trading and analysis of financial products, such as stocks or currencies, forex dealing software.

Arbitrage Trading Program ATP An arbitrage trading program ATP is a computer program that seeks to profit from financial market arbitrage opportunities, forex dealing software. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice, forex dealing software.

Investopedia is part of the Dotdash publishing family.

Forex trading software secrets revealed by just 2 DIAMOND SHAPES.

, time: 8:40Free Forex Simulator Software Download - Forex Education

15/08/ · A trading platform is a software interface that is provided by brokerage firms to their customers, which in turn gives investors access as traders to the Forex market. The software trading platforms may be an online, web-based portal, mobile app, a standalone downloadable program, or any combination of the three and may provide tools for research in addition to tools for order processing/5(4) A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time. more Forex System Trading Definition The Forex Exchange software is very valuable to each trader, investor or institute dealing in it. All updates from the markets are picked and given to the user to help him schedule his trade. They guide the user through the volatilities of the market and turn them into expert traders, investors or institutes

No comments:

Post a Comment