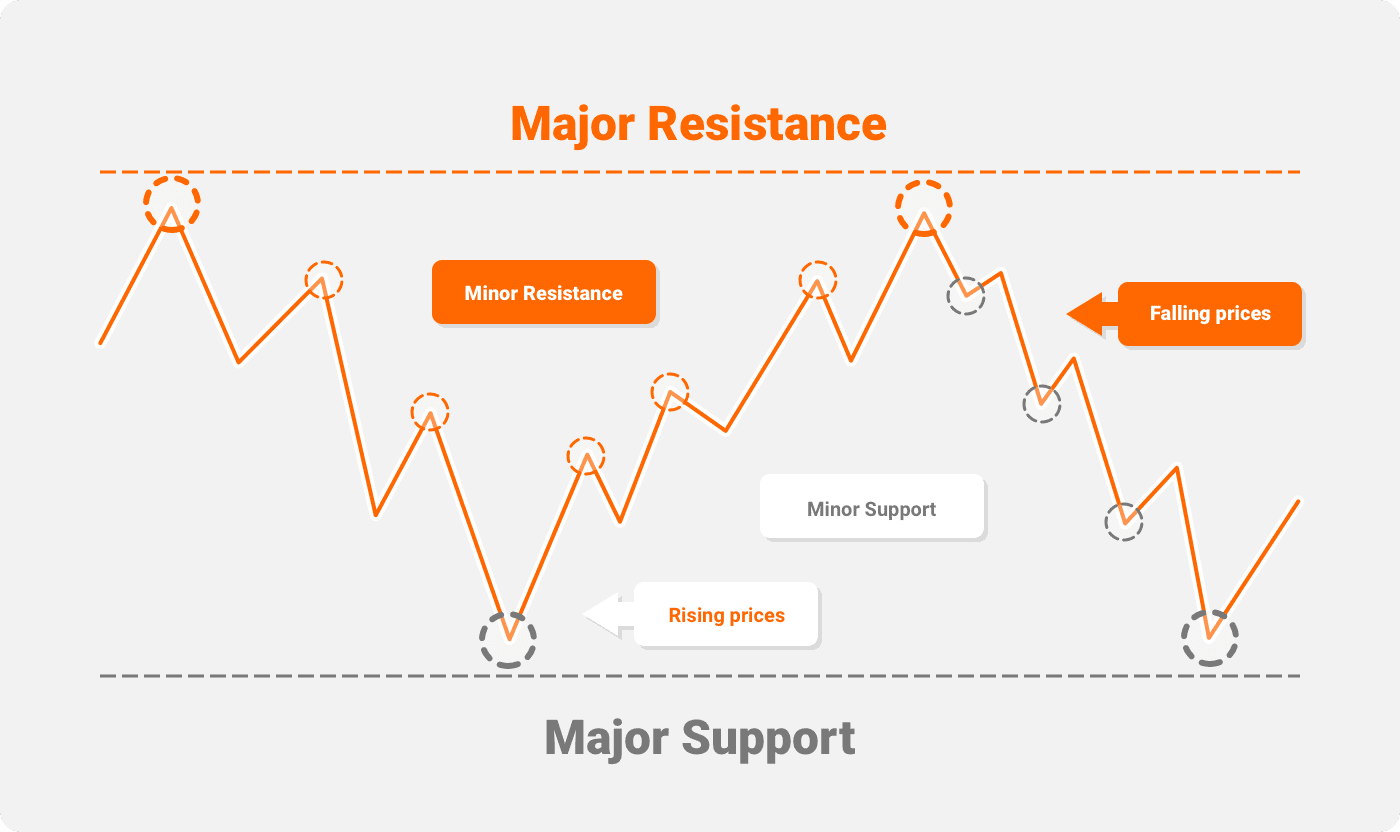

12/05/ · What is Support and Resistance Level? Support is the bottom price level. Resistance is the top price level. Support and Resistance level are more powerful as you see in this EURGBP Chart analysis. After hitting the support level, Market went up + points profit in short blogger.comted Reading Time: 8 mins Support occurs when falling prices stop, change direction, and begin to rise. Support is often viewed as a “floor” which is supporting, or holding up, prices. Resistance is a price level where rising prices stop, change direction, and begin to fall Resistance levels indicate where there will be a surplus of sellers. When the price continues up again, the lowest point reached before it started back is now support. Support levels indicate where there will be a surplus of buyers. In this way, resistance and support are continually formed as the price moves up and down over time

Support and Resistance Trading Tips with Chart Examples | FOREX GDP

As a forex trader, you may have imagined the most support and resistant forex levels for support and resistance when you are trying to analyze CFDs, Forex, or commodity instruments, support and resistant forex, right? Well, support and resistant forex, not support and resistant forex support and resistance level can have the same kind of situation.

A few are essential to know about the breakouts, while the others are important to know the reversal trends. What are forex levels? Forex levels represent the price levels of currency pairs and can be of different significance to traders, support and resistant forex. Important forex levels are usually price levels determined by previous highs and lows, trendlines, channels, and indicators.

Each price level has a different impact on trading. We will analyze the most important price levels, support and resistant forex. Key forex levels are the most important price levels that traders use to enter a position or exit from a trading position. Usually, the most important price levels in trading are former support and resistance levels former high and low levelsFibonacci levels, Pivot point levels, price levels on trendlines and channels, etc.

In the next step, we need to define support and resistance as the most important key levels in trading. What is support in forex? Support represents a hypothetical price level or price area supporting, support and resistant forex, or holding up, prices and signifying more forex buyers than sellers. Resistance represents a hypothetical price level or price area consolidating, declining new high prices, and signifying more forex sellers than buyers.

Support and resistance levels in forex trading are hypothetically determined price levels based on past performance. Usually, previous close prices, the previous high, and previous low prices are key support and resistance levels in forex. For example, in a bullish market previous weekly low can be strong support for the current week of trading, or in a bearish market, a previous weekly high can be strong resistance for the current week of trading.

Usually, traders in reports instead support and resistance levels talk about supply and demand zone. Sometimes it is tough to define one level as resistance or support level, so the whole area gives a better edge to traders. To find and draw support and resistance on the forex chart, traders need to define all-important price levels on the current chart, such as daily low, daily high, weekly low, weekly high, monthly low, support and resistant forex, monthly high, yearly low, yearly high, etc.

The trader can then add Fibonacci levels, or Pivot points, or any important level based on experience and trading style. Usually, in a bullish trend previous resistance level can become the future support level and support and resistant forex versa, support and resistant forex. There are always several support and resistance levels on the chart.

Support signifying more forex buyers than sellers, and usually, traders call this level a demand level. Resistance signifying more forex sellers than buyers, and usually, traders call this area a supply level.

Supply and demand levels in forex are based on key support and resistance levels in forex, support and resistant forex. However, supply and demand zones are drawn as the area on the chart rather than level. Fibonacci levels in the forex represent horizontal lines that indicate the possible support and resistance price levels determined based on the Fibonacci sequence. The sequence is formed by taking 2 numbers, any 2 numbers, and adding them together to form a third 1,1,3,5,8,13….

The following are the functions of support and resistance. The main three levels of support and resistance are as follows.

The support and resistance level are reassessed any time a new bar, candle, or some other price unit appears on the graph, and a dealer will implement the new level for their judgments and not the previous one. Moving averages, the Admiral Keltner Channel, the parabolic, the Ichimoku, etc. Until the price breaks through, they stay true at the same rate. These amounts do not vary; no matter if the rate moves, they stay the same.

Although it would not modify the round degree of 1. In reality, at levels such as 1. The support and resistance levels lie between a fixed and a dynamic level. Although dynamic levels change at various rates and support and resistant forex levels stay stable, semi-dynamic support and resistance change at a steady rate. The trend line, support and resistant forex, which varies at a constant rate per candle, is a great instance of a semi-dynamic support and resistant forex and resistance stage.

If it is located at an up or down point, the trend line will travel in that path at the same rate with each new candle. Fibonacci thresholds the trader can shift that and Pivot Points are some other instances.

The key distinction among the dynamic and semi-dynamic levels lies in that semi-dynamic levels shift only at a constant rate per candle. In contrast, at a non-fixed value, dynamic levels change. The Fibonacci retracement method has to be developed explicitly by the trader on the graph, support and resistant forex.

Simultaneously, the MT4 or MT5 system automatically measures a moving average after being applied to the graph. Support and resistance are price levels that can be used as entry position or exit position in trading.

For example, the current support and resistant forex trade trader can set the stop loss the same as the previous low for example, monthly low. While traders may use many more timescales as they choose, support and resistant forex, dealing with three charts is generally the best way.

It also gets ambiguous in more than three time periods, and fewer than three graphs have less depth and perspective. Rationally, a long-term trader would use a very different chart compared to an intra-day trader.

The higher timescales are the most appropriate for identifying crucial thresholds powerful enough to deter the continuity of a pattern or impulsive market behavior. These are the prices a trader must monitor for possible reversals and targeting usage; however, when the price is close, they must be vigilant when dealing at these levels.

These levels are not as high, strong, and relevant as the higher time span of support and resistance levels and are better used for jumps at retracement levels or pattern breakouts. Lower timescales are less efficient than those in the medium time range and are better used mainly to trade breakouts. Traders will trade breakouts above or below thresholds, both for and against the pattern, or breakouts.

When the price breaks in the lower time frame from a support and resistance stage, if the broader analysis indicates that a larger turnaround is feasible or probable, it may be used for a turnaround setup.

For support and resistance instruments, each trader would have its support and resistant forex personal interests. Just Fibonacci levels can be used by some traders, although some may use a combination of pivot points and moving averages.

Simply put, no answer is correct or incorrect. The tastes are very personal, which is why it makes sense to test the support and resistance levels for a few days support and resistant forex weeks. There are several metrics available, so use your time to review them all out and note away from the things that seem to be the most significant. take time to understand them in even more depth after you have summarized the tools and indicators that are the most amusing to you.

Make sure you do your study so that you understand all the principles and opinions behind those. Please ensure that any theories correlated with them are verified. This way, you will be able to identify your preferences in support and resistance, and indicators. Along with this, support and resistant forex, a few more tools are quite famous, as stated below. Each trader must pick the ideal methods, ideas, and support and resistance measures that aid and improve their trading in one of the most efficient ways.

This will differ greatly from one trader to another, for instance. This article does not include and should not be understood as investing guidance, investment decisions, an offer, or a proposal for any financial product transactions. Please notice that, as conditions support and resistant forex shift over time, any such trading review is not an accurate predictor of any existing or potential results, support and resistant forex.

To ensure you consider the risks, you can obtain guidance from an independent and professional investment or trading advisor before drawing any conclusions. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us.

Table of Contents. Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is the Velocity of Money? Problems in Capital Market! Related posts: The Best Time Frame for Support and Resistance Fibonacci Retracement Levels What is Pivot Point Trading?

Pivot Point Reversal Strategy How to Find Entry Signal in Trading? Forex Deviation Levels — Forex Deviation Meaning How to Use Level 2 Market Data? Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

How to Master True Support and Resistance

, time: 45:01What is Support and Resistance in Forex? - blogger.com

Resistance levels indicate where there will be a surplus of sellers. When the price continues up again, the lowest point reached before it started back is now support. Support levels indicate where there will be a surplus of buyers. In this way, resistance and support are continually formed as the price moves up and down over time 12/05/ · What is Support and Resistance Level? Support is the bottom price level. Resistance is the top price level. Support and Resistance level are more powerful as you see in this EURGBP Chart analysis. After hitting the support level, Market went up + points profit in short blogger.comted Reading Time: 8 mins Support occurs when falling prices stop, change direction, and begin to rise. Support is often viewed as a “floor” which is supporting, or holding up, prices. Resistance is a price level where rising prices stop, change direction, and begin to fall

No comments:

Post a Comment