12/08/ · A trailing stop is a stop-loss order that tracks the price of the asset you are trading and is automatically adjusted. The trailing stop is different from the traditional stop-loss order as it moves in line with the asset’s price, hence, securing your blogger.comted Reading Time: 9 mins Trailing Stop Technique For A Downtrend Market. This first chart above shows you the market in a downtrend. After your trade is in profit, you wait for lower swing highs that form and just place your trailing stop a few pips above them. you trail stop your profitable trade until price moves back up and intersects the most recent swing high, then you get stopped out with profit. Trailing Stop Technique For An Uptrend MarketEstimated Reading Time: 2 mins 09/04/ · The simplest trailing stop that you can use is the 1R breakeven trailing stop. This is when you move your stop loss to breakeven when price hits 1R, or one multiple of risk. For example, if your stop loss was at pips, you would move your stop to breakeven when your profit hit blogger.comted Reading Time: 8 mins

How to Use Trailing Stop Loss (5 Powerful Techniques That Work)

If you are tired of missing out on profits what is trailing stop in forex simplest form you close a trade, then this post is for you. Trailing your stop loss can be a great way to lock in some gains, while letting your profits run. Get the pros and cons of each of these 7 popular trailing stop loss methods. By Hugh Kimura. One way that profitable traders maximize their winners is to trail their stop losses. Remember that successful trading is all about figuring out what works for you.

These strategies can work well with some entries and not so great with others. Always test your current exit strategy against a trailing stop loss, before using it in live trading. Also remember to try one thing at a what is trailing stop in forex simplest form. This trailing stop loss uses multiples of risk and can be an easy way to automate your stop loss strategy.

So when your trade is pips in profit, you will move your stop loss to breakeven. So you might get stopped out in very volatile market conditions. Now, using the risk multiple can factor in volatility a little because your stop loss will tend to be a little wider in more volatile market conditions.

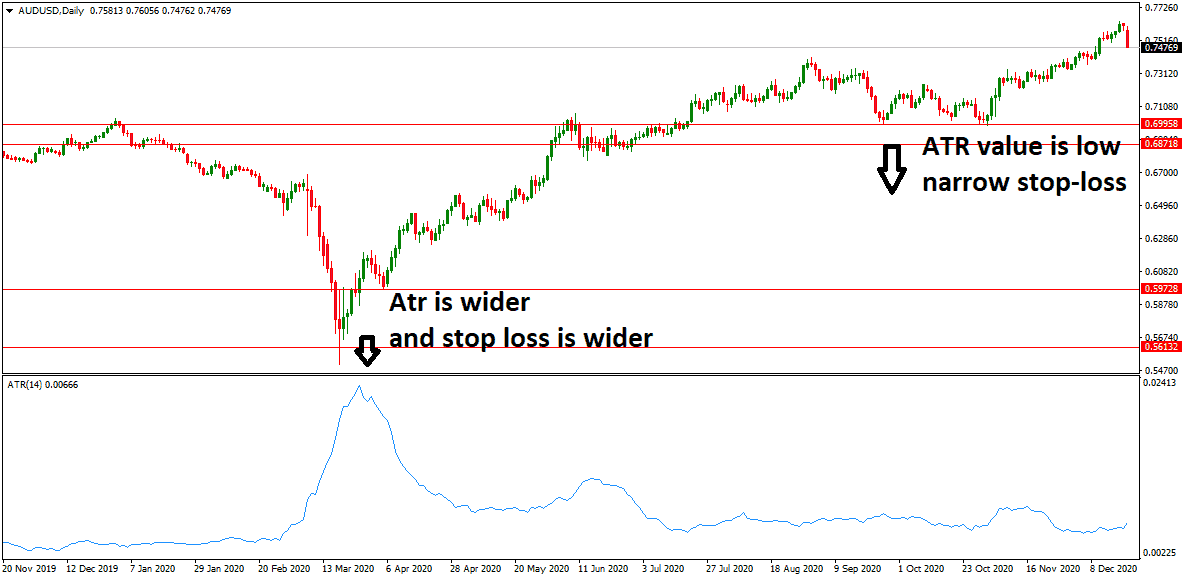

But the levels are not adjusted according to indicators like Average True Range ATR or other similar measurements of volatility. This method also might not work well with very volatile currency pairs or pairs with large spreads.

So you also need to consider those elements. This method eliminates any second guessing as to when and where your stop loss should be moved. You can either set price alerts on your charts manually with TradingViewwhat is trailing stop in forex simplest form, or you can use a MetaTrader 4 indicator at each R-level.

Another way to do this is to use an automated Expert Advisor EA for MT4, like this one. The Parabolic SAR was invented by Welles Wilder and it can be a good way to see when momentum could be coming to the end. As you can see in the chart above, the indicator can be a good way to lock in profits in a trend. The important thing to figure out is if this method gives you an edge in the markets.

Be sure to backtest the strategy and keep track of your missed trades. This exit strategy is pretty forgiving when it comes to riding trends. The indicator gives a good stop loss cushion when markets are moving fast, but tightens up the stop when things get quiet. Another way that you can trail your stop loss is to use the highest high, or what is trailing stop in forex simplest form low of the last X-number of bars.

If you go short, you would move your stop loss to the highest high of the last 3 bars. You could also add a criteria that the trade needs to be at least 1R in profit, before you start trailing the stop.

This can create a fairly tight stop loss and you will probably get stopped out pretty often, before you catch a runner, what is trailing stop in forex simplest form. So if you are the type of trader that needs to win a lot, then this might not be the exit strategy for you, what is trailing stop in forex simplest form. Like the other methods in this post, this trailing stop might not work with your entry signal. So test, test, test …before taking it live. The exit strategy is very straightforward and can be automated.

This method can help you catch big moves, while keeping your losses small. Traders who enjoy the satisfaction of catching the occasional multi-R runner, should probably test this strategy. You can also wait for support or resistance levels to what is trailing stop in forex simplest form during the course of your trade to move your stop loss.

You really need to practice this method to become confident in this exit method. Out of all of the exit methods on this list, this one provides the most latitude to improvise. Obviously this freedom can be a double-edged sword. But for traders who perform better with a more intuitive approach to trading, this can give them the leeway to be more flexible in their exit, while locking in those sweet profits.

This method is similar to the X-bar trailing exit, but you would trail your stop loss on every new candle, what is trailing stop in forex simplest form, plus a certain number of pips, to give you a cushion. A popular way to add a cushion is to add a percentage of the Average True Range ATR indicator. If the current ATR value is 60 pips, you would simply add 30 pips to the high or low of each candle to determine your stop. You could get stopped out very quickly in low volatility market conditions.

But again, that could happen with any trailing stop method. This is another cut-and-dry exit strategy and eliminates any guesswork. It can also be partially automated. If this strategy works for you, a simple EA could be used to trail your stop loss while you are away from your computer. No problem, this list of programmers can help you create the EA you need. Another way that you could trail your stop loss is to use a moving average.

Every time a new bar prints, you would simply move your stop loss to the moving average price of the last bar. A popular moving average is the 20 exponential moving average 20EMA. That can be a good place to start, but you should certainly test various types and periods of moving averages.

This is another black-and-white trailing stop method that is easy to automate. No second-guessing here. The simplest trailing stop that you can use is the 1R breakeven trailing stop. This is when you move your stop loss to breakeven when price hits 1R, or one multiple of risk. For example, if your stop loss was at pips, you would move your stop to breakeven when your profit hit pips. So if you went short on this chart, you would move your stop to breakeven as soon as price hit the bottom of the green box.

Moving your stop to breakeven can stop you out before your trade goes uber-profitable. So you have to test to see if a 1R stop would work well with your trading strategy. But this one simple tweak can reduce your average loss, which can improve the overall return on your account. There can be two important benefits to moving your stop loss to breakeven, what is trailing stop in forex simplest form. First, you can lock in a trade that is going in your direction.

That can lift a huge weight off your shoulders and allow you to see the charts more clearly. Second, once your trade is locked in at breakeven, this gives you the freedom to take more trades.

When you take more trades, you increase the number of times that you apply your edge. The trailing stop that you use will depend on your entry method and your Trading Personality. If you are looking for a way to let your winners run, what is trailing stop in forex simplest form, test out a few of these strategies. You can also use a split entry to take advantage of a trailing stop, while still using whatever works for you right now.

Then again, you might not want to use a trailing stop loss at all, it might be better for you to set a take profit level. Hi, I'm Hugh. I'm an independent trader, educator and international speaker.

I help traders develop their trading psychology and trading strategies. Learn more about me here. Get the FREE Guide to Picking the Best Trading Strategy For YOU. Skip to primary navigation Skip to main content Skip to footer 7 Trailing Stop Loss Strategies That Work If you are tired of missing out on profits after you close a trade, then this post is for you.

SEE ALSO: The Easiest Way to Automate Your Trading Strategy without knowing programming. SEE ALSO: The Trading Books That Changed My Life.

Related Articles. Are You Trading The SWAG Forex Trading System? Here Is How To Tell. How to Find the Best Place to Set Your Stop Loss. Trending Outside Bar: Forex Trading Strategy Plan Version 1. Share This Article. What is trailing stop in forex simplest form posted: April 9, Last updated: February 21, Get Instant Access.

What are Trailing Stops and How to Trade with Them? ☝️

, time: 7:14This Is The Best Trailing Stop Technique (2 Charts Reveals All)

28/10/ · A trailing stop loss is an order that “locks in” profits as the price moves in your favor. You can trail your stop loss using: Moving Average, Average True Range, percentage change, market structure, and weekly high/low. There’s no best method to trail your stop blogger.comted Reading Time: 6 mins Trailing Stop Technique For A Downtrend Market. This first chart above shows you the market in a downtrend. After your trade is in profit, you wait for lower swing highs that form and just place your trailing stop a few pips above them. you trail stop your profitable trade until price moves back up and intersects the most recent swing high, then you get stopped out with profit. Trailing Stop Technique For An Uptrend MarketEstimated Reading Time: 2 mins 12/08/ · A trailing stop is a stop-loss order that tracks the price of the asset you are trading and is automatically adjusted. The trailing stop is different from the traditional stop-loss order as it moves in line with the asset’s price, hence, securing your blogger.comted Reading Time: 9 mins

No comments:

Post a Comment