Forex Trading Strategy; Support and Resistance; Read the Chart Patterns; Price Action Confluence; Entry Trigger Mechanism; Using Market Layers; Stop Loss Protection; Take Profit Projection; Applying Risk Reward; Set and Forget Psychology; Experiencing Trade 1; Experiencing Trade 2; Experiencing Trade 3; Increase Trade Frequency; Practice on a Free Demo; Learn About MembershipEstimated Reading Time: 8 mins Advanced Forex Strategies Part 3 - Three Point Arbitrage (TPA) Three Point Arbitrage is based on the concept of "Relative Arbitrage" and was designed to exploit price disparities among three currency pairs. It is one of the Forex Hedge Fund Strategies used to capitalize on the triangular relationship between two 07/07/ · 3 Profitable Pivot Point Strategies For Forex Traders. Posted by By Mary Davis July 7, No Comments. Table of Contents. Floor Traders Pivot Points (standard Pivot Points) How To Measure Market Sentiments Using Pivot Points; Forex Pivot Point Trading Strategy;

Forex Strategy «3 touch» | FOREX Strategies

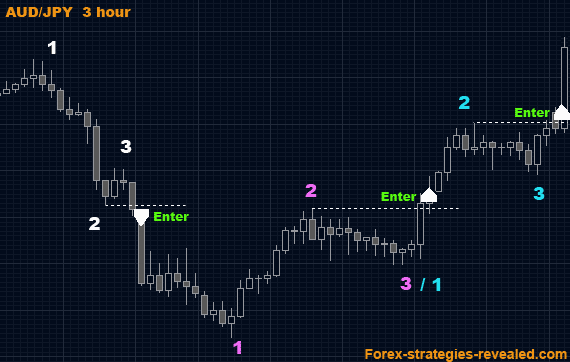

The Forex trading strategy is based on price action and normal Forex market structure that any trader should know. The 1 2 3 trading strategy is used as a continuation trading setup that is designed to take advantage of the trend of the market. The failure of the trading strategy is also a trade setup but can also warn you of potential price consolidation in the market or even a trend reversal in whatever Forex pair you are watching.

Keep in mind that 3 point strategy forex though it is a continuation pattern upon confirmation, it is also a reversal pattern from the short term trend direction, 3 point strategy forex.

In any trending market, there is a pattern of higher highs and higher lows. In order for the trend to the upside to remain active, each successive impulse swing must take out the point 2 in the formation.

When price surpasses the price at 2, the trader can use that as confirmation that the 1 2 3 chart pattern is present. This is a line chart that explains the concept of the 1 2 3 trading pattern and in this case, we are assuming an up trending market. Please note that the 1 2 3 price pattern is only confirmed once the high at point 2 is taken out by price. You can also see that the 1 2 3 trading strategy is taking advantage of the stair step nature of the market that is needed if a trend is going to continue.

It is at the confirmation of the patter that a trader can place a conservative trading position in the market, 3 point strategy forex. We will look at a conservative method for those traders that need a little extra confirmation in 3 point strategy forex trades. Keep in mind there is a cost involved. The longer you wait to get involved in a trading 3 point strategy forex, the larger you will have to make your stop loss.

You should be familiar with the numbers and what they represent on the chart, 3 point strategy forex. We can see that price rallied from point 3, found resistance at point 2 and retraced. We now have a double bottom chart pattern and just as the 1 2 3 trading strategy needs a breach of 2 to confirm the pattern, so does the double bottom.

If you do get a double bottom after a move in price, that could signify weakness in the market. If bulls were fully in chart during the retrace at 2, we should not see two shots at the level 3. Price breaks above 3 point strategy forex and you can either enter at the breakout or, my preference, take a position at the close of the candlestick to confirm a true break.

You can also put an order to buy slightly above the candlestick that broke the 2 level. Your stop loss should be below 2 with buffer room to allow for noise. You can also, my preference is coming, use a 14 period Average True Range x 2, 3 point strategy forex.

Price rallies from 1 and gives us a strong reversal candlestick at 2. Once price begins to retrace, put this currency pair on your radar. Price find support at 2 inside the previous consolidation pattern from trade 1 and shows strength as it rallied to 2. Once price shatters the 2 price zone, enter at the close of the daily candlestick or whatever time frame you are using and use an ATR stop.

The average true range stop for this trade would actually be in the middle of the candlestick that printed just before the breakout candlestick. We have most variables need for the 1 2 3 trading strategy but price is forming a range near the level at 3. When price is basing in this fashion, it shows that the side that was dominant, in this case bulls, have tired. As a trader for years, I have seen the following occur:.

This formation of the consolidation is also a great trade entry into the potential of the 1 2 3 chart pattern continuing. We can position early in the 1 2 3 formation when we have basing occurring. Ideally, we would like to see some form of basing near the resistance level red line. You can see the green dashed line and then price rockets to resistance.

The more favorable setup is to have either basing near the extreme or a slight pullback in price which we see with orange box. The break out then occurs after that pullback. Those types of breaks are more effective and see if you can understand why. Some would think the first break would carry more weight because the drive started midway in the range.

But traders who positioned lower will also look for scalping Forex trades at the top of the range — is that not how you play a range?? The breakout that occurs is driven by traders who went long at the bottom of the range.

As discussed, you can enter at the close of the break out candlestick signal candlestick or entering your trading position at a break of the high. Some traders may want to use a multiple time frame approach and enter on a lower time frame. In my own trading and in my years as a trader, I look to simplify.

Entering at close or breaks of support levels or resistance levels highs and lows of breakout candlesticks is my favored entry. Some traders would like to see specific price targets to add to their trading plan. Other traders see the power of trailing their stop loss to take as much as the market is willing to give, 3 point strategy forex.

I color coded each swing so you can see where I am measuring from. You can see the first two trades nailed the targets. The third trade hits the. The 1 2 3 trading strategy is a pure price action trading method that uses a sound approach to trading. This is a line chart that explains the concept of the 1 2 3 trading pattern and in this case, we are assuming an up trending market 1 2 3 Trading Strategy.

RELATED Inside Bar Forex Trading Strategy-Learn How to Trade Inside 3 point strategy forex. Front Running. RELATED Three White Soldiers Three Black Crows Forex Trading Strategy. One to One Targets. Prev 3 point strategy forex Next Article.

Sniper Entry Strategy - Forex Trading

, time: 4:28TOP 3 most profitable forex strategies – Forex strategies

In an uptrend market situation, price will make 3 points. Point 1 is the lowest low point, forms a support level. Point 2 will be the peak or the highest point, forms a level that we consider as potential resistance; Point 3 will be the 2nd low point, a support level (which must be higher that the point 1 which is the lowest low point).Estimated Reading Time: 8 mins 28/08/ · In this strategy forex «3 touches» we’ll talk about how to conduct themselves within the existing trend in the market. And in this case the best moments of entering the market based on the use of trend lines using a support or resistance, which are determined by the last completed trends Advanced Forex Strategies Part 3 - Three Point Arbitrage (TPA) Three Point Arbitrage is based on the concept of "Relative Arbitrage" and was designed to exploit price disparities among three currency pairs. It is one of the Forex Hedge Fund Strategies used to capitalize on the triangular relationship between two

No comments:

Post a Comment