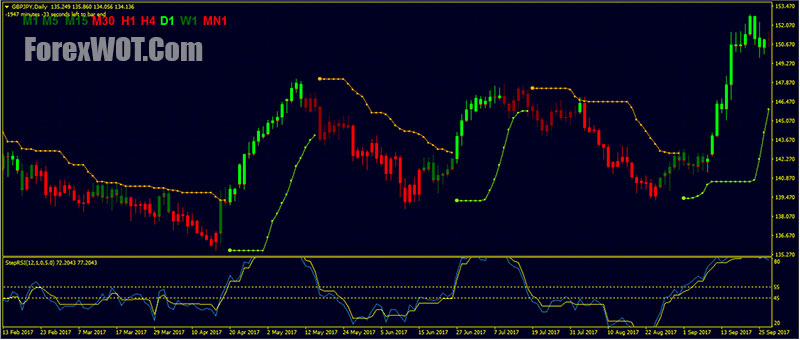

08/01/ · RSI divergence may be rarer than standard RSI entries, but traders still need to look at these potential setups with context: Using risk-reward ratios of 1-to-2 or greater when looking for reversals 14/03/ · {quote} The RSI levels can be altered through the inputs and if you want to use it the same as the standard indicator set the RSI Upper level to 0 and the RSI Lower level to then the levels will revert back to the standard MT4 level settings in the indicator. {image} {file} Please consider there are only a few coders and a lot of requests and it is all done on a voluntary basis 20/05/ · The actual RSI value is calculated by indexing the indicator to , through the use of the following RSI formula example: RSI = - ( /1 + RS) If you are using MetaTrader (MT4), you can attach the indicator on your MT4 chart, and simply drag and drop it to the main chart window

Awesome Oscillator + RSI Forex Strategy - Catch the Momentum Turns

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies, step rsi forex-station. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. Talking Points:.

As traders, they can help us simplify past proceedings on the chart; but without proper context, indicators can cause traders to lose significant amounts of money.

Technical Analysis can help traders associate the probabilities of success; and indicators can help traders more easily identify high-probability setups. One of the more universally accepted indicators is RSI, or the Relative Strength Index.

But RSI can offer traders quite a bit more than just what it can do by step rsi forex-station. We covered this in the article, RSI: The Relative Strength Index. We also created a Brainshark course to help traders better learn the indicator. After completing the information in the guestbook, the lesson will begin. Relative Strength Identification. Taken from RSI: The Relative Strength Index.

Once RSI begins moving out of that area, traders can look to trigger a trade in the opposite direction selling when price leaves overbought territory and buying when RSI leaves oversold territory. This, step rsi forex-station, in and of itself can be effective; particularly when looked at on longer-term charts and step rsi forex-station with effective money management. Method 1: Daily Chart with 1-to-2 Risk-to-Reward Ratio. The simplest way to trade with RSI can also be one of the more effective.

As an example, EURUSD had five RSI crosses on the daily chart inall of which were sell entries as RSI moved down and through Each of these are identified and numbered on the chart below:. RSI Crossovers can precede enormous movements. More interesting: the pair trended higher on the year; opening the year at 1. And yet, we only saw 5 signals, all of which were counter-trend; and step rsi forex-station of which could have worked out beautifully.

So, even though EURUSD worked higher during the year, three of the five sell signals per RSI could have equated to profitable trades. Traders can take this a step further by adjusting their risk-reward ratio; because, after all, step rsi forex-station, RSI crossovers are counter-trend entries looking for near-term retracements.

If those retracements catch to turn into a full on reversal such as signal 1 in the above chartthe potential return step rsi forex-station be large and outsized. Method 2: Catching Reversals with RSI Divergence. RSI Divergence step rsi forex-station be an extremely interesting way to trade with Relative Strength. My colleague Walker England beautifully outlined RSI Divergence in the article, Step rsi forex-station to Trade RSI Divergence.

One of the brightest allures of RSI Divergence is the potential for large reversals. Key importance with RSI divergence is risk management; because if the trend does not reverse, the trade can be extremely costly as the trader sits in a counter-trend position.

RSI divergence may be rarer than standard RSI entries, but traders still need to look at these potential setups with context: Using risk-reward ratios of 1-to-2 or greater when looking for reversals.

In the article How to Trade Reversalswe go more in-depth behind the importance and application of risk management when treading in these treacherous terrains, step rsi forex-station. Method 3: As a Trigger with a Longer-Term Trend Filter. Multiple Time Frame Analysis can bring considerable value to the technical trader; key of which is allowing the trader to assimilate price action from varying points of view. Traders can look to the longer-term chart to get an idea for the general trend direction; and then look to enter on the shorter-term chart in consideration of the longer-term trend.

A primary example of this form of analysis would be the combination of the Daily and the 4-hour chart. Traders can observe the trend on the daily chart, and then after grading the trend can look to place entries on the 4-hour chart. We went over this strategy, as well as shorter and longer-term horizons in the article, Trading Trends with RSI.

Traders can grade trends on the daily chart with any of a number of trend-identification mechanisms: Price Action, Moving Averages, and ADX The Average Direction Index are all extremely popular options when grading trends.

After the trader has identified the trend, they can move down the lower time frame to look to trigger an entry in the direction of that trend. Multiple Time Frame Analysis can help traders use RSI more effectively. Taken from Trading Trends with RSI. James step rsi forex-station available on Twitter JStanleyFX.

Would you like to enhance your FX Education? DailyFX has recently launched DailyFX University ; which is completely free to any and all traders! DailyFX University. Forex Education. Forex — Secrets of Profitable Forex Traders. Use the News. DailyFX provides forex news and technical analysis on the trends that step rsi forex-station the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors, step rsi forex-station.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, step rsi forex-station, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0.

Duration: min. P: R:. Search Clear Search results. No entries matching your step rsi forex-station were found. English Français 中文(繁體) 中文(简体). Free Trading Guides, step rsi forex-station. Step rsi forex-station try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes, step rsi forex-station. Currency pairs Find out more about the major currency pairs and what impacts price step rsi forex-station. Commodities Our guide explores the most traded commodities worldwide and how to start trading them.

Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Balance of Trade AUG. Gfk Consumer Confidence SEP, step rsi forex-station.

F: P: R: Inflation Rate YoY AUG. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Step rsi forex-station. Company Authors Contact. of clients are step rsi forex-station long. of clients are net short. Long Short. Oil - US Crude. News Crude Oil Technical Outlook: Short-term Bias Still Bullish, Big Level Ahead Wall Street, step rsi forex-station. News Wall Street IG Client Sentiment: Our data shows traders are now net-short Wall Street for the first time since Sep 14, GMT when Wall Street traded near 34, Dow Step rsi forex-station Price Resilient After FOMC Rate Decision, Updated Rate Projections News Live Data Coverage: September Federal Reserve Meeting, Rate Decision More View more.

Mladen's Step VHF Adaptive VMA Indicator FREE DOWNLOAD

, time: 5:23!!Step rsi (floating levels).ex4

20/05/ · The actual RSI value is calculated by indexing the indicator to , through the use of the following RSI formula example: RSI = - ( /1 + RS) If you are using MetaTrader (MT4), you can attach the indicator on your MT4 chart, and simply drag and drop it to the main chart window Awesome Oscillator + RSI Forex Trading Strategy. We are going to combine the awesome oscillators ability to help determine momentum with the RSI overbought/oversold condition to produce a trading strategy. This is a form of technical analysis and we will use price action to trigger us into a trade 03/09/ · Hi does any one use the Stochastic-RSI,a 14 day Stochastic oscillator applied to a 9 day RSI as featured in the Sept Currency Trader Mag,would they be kind enough to direct me to a source to download the metatrader indicator for it,many thanks jonmem Forex Factory® is a brand of Fair Economy, Inc

No comments:

Post a Comment